%matplotlib inline

import matplotlib.pyplot as plt

import numpy as np

from io import StringIO

import pandas as pd

import scipy.optimize

plt.rcParams["figure.figsize"] = (10,10)

from warnings import filterwarnings

filterwarnings('ignore')The Context

The thesis of this post is pretty simple. There is a delay between customers making a transaction and when Afterpay realises they have defaulted. Because of this delay, combined with the rapid growth in the total value of transactions, defaults may be artificially reduced as a percentage of transaction value.

Obviously, I need a disclaimer. If you use anything I say as the basis for any decision, financial or otherwise, you are an idiot.

The Model

First off, let’s load in a bunch of libraries.

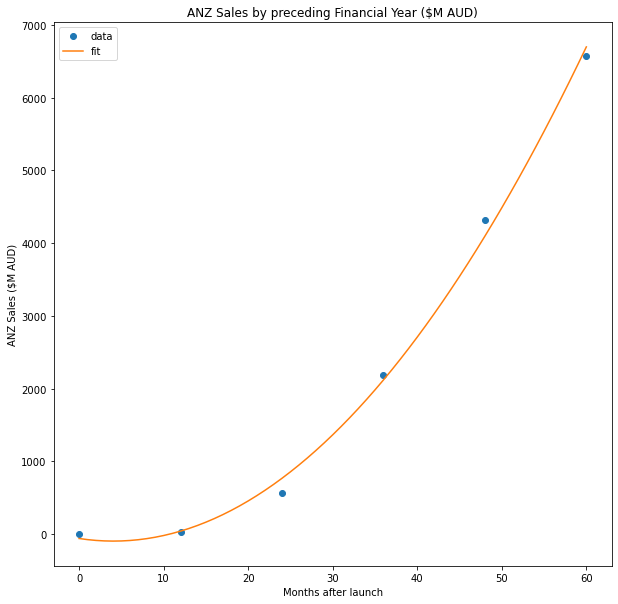

While reading through Afterpay’s releases to the markets, I came across this chart, which appears on page 3 of this release. Let’s use this to build a simple quadratic model of the reported sales.

Loading the data

#Underlying sales

csv_data = StringIO('''anz_underlying_sales_value,date,month_count

0,FY15,0

37.3,FY16,12

561.2,FY17,24

2184.6,FY18,36

4314.1,FY19,48

6566.9,FY20,60''')

df = pd.read_csv(csv_data, sep=",")Fitting a curve

Let’s first fit quadratic:

def quadratic(t, a, b, c):

y = a * t**2 + b * t + c

return y

xdata = df.month_count.values

ydata = df.anz_underlying_sales_value.values

popt, pcov = scipy.optimize.curve_fit(quadratic, xdata, ydata)

print(popt)[ 2.17012649 -17.61639881 -58.725 ]x = np.linspace(0,60, 61)

y = quadratic(x, *popt)

plt.plot(xdata, ydata, 'o', label='data')

plt.plot(x,y, label='fit')

plt.title('ANZ Sales by preceding Financial Year ($M AUD)')

plt.xlabel('Months after launch')

plt.ylabel('ANZ Sales ($M AUD)')

plt.legend(loc='best')

plt.show()

Delays in reporting.

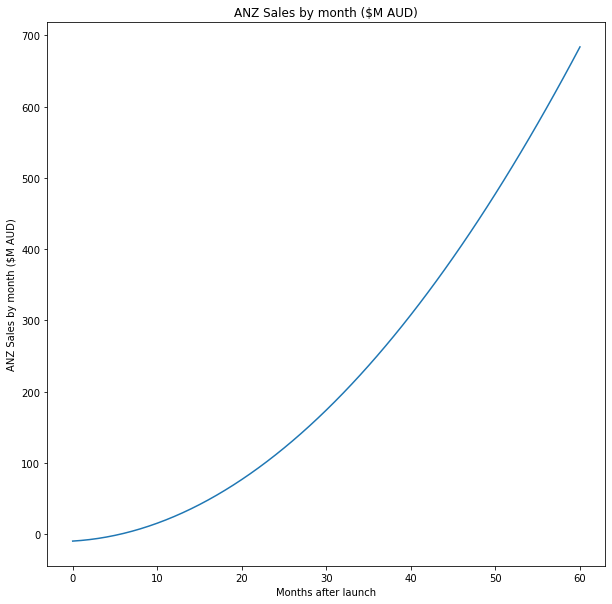

So we found that we could model the annual reported sales as \[2.170 t^2 - 17.61t - 58.725\]

The instantaneous sales rate is \[0.1808t^2 + 0.7021t -9.36\].

Don’t worry about how I arrived at this; I will show how in the appendix of this post.

t = np.linspace(0,60, 61)

sales = 0.1808*t**2 + 0.7021* t - 9.36

plt.plot(sales)

plt.title('ANZ Sales by month ($M AUD)')

plt.xlabel('Months after launch')

plt.ylabel('ANZ Sales by month ($M AUD)')

plt.show()

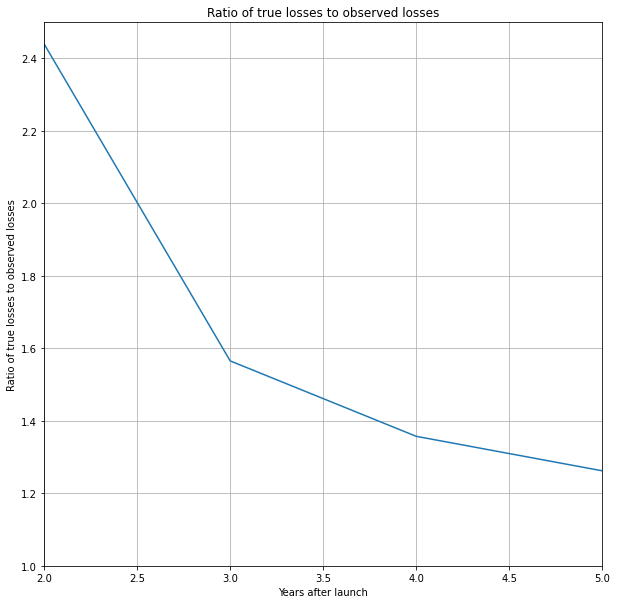

Now let’s model a delay of 6 months between when the transaction happens and when Afterpay finally realised there was a default.

From this, we can see a significant difference between the actual rate at which losses occur and the rate at which we observe them occurring at any time.

delay = 6 #months

true_loss_rate = 0.01

losses_true = true_loss_rate*(0.1808*t**2 + 0.7021* t - 9.36)

losses_observed = true_loss_rate*(0.1808*(t-delay)**2 + 0.7021* (t-delay) - 9.36)

plt.plot(losses_observed,label='Observed')

plt.plot(losses_true,label='True')

plt.legend()

plt.title('ANZ losses by month ($M AUD)')

plt.xlabel('Months after launch')

plt.ylabel('ANZ losses by month ($M AUD)')

plt.show()

Now let’s integrate by financial year.

def integrate_by_year(y):

integrated = np.array([0,np.sum(y[0:12]),np.sum(y[12:24]),np.sum(y[24:36]),np.sum(y[36:48]),np.sum(y[48:60])])

return(integrated)

observed_loss_rate = integrate_by_year(losses_true)/integrate_by_year(losses_observed)

plt.plot(observed_loss_rate)

plt.title('Ratio of true losses to observed losses')

plt.xlabel('Years after launch')

plt.ylabel('Ratio of true losses to observed losses')

plt.ylim(1,2.5)

plt.xlim(2,5)

plt.grid()

plt.show()

Conclusion

In conclusion, we can see the impact of a delay in recognising losses in situations with rapid growth. Even after years of growth, with a six-month delay in recognising losses, the actual losses could be 30-40% higher than reported.

Appendix

Finding an integral

So we found that we could model the annual reported sales as \[2.170 t^2 - 17.61t - 58.725\]

Let’s call this function \(f(t)\)

We want to find the function \(g(t)\), which is the underlying sales rate I claimed was: \[0.1808t^2 + 0.7021t -9.36\].

When integrated over 12 months, this function will give us the annual reported sales.

To help us with the algebraic manipulation, we can use Sympy. An alternative is to do the algebraic manipulation by hand, which is probably faster and more scalable.

import sympy as sym

sym.init_printing(use_unicode=True)

a,b,c,d,t = sym.symbols('a b c d t')We are looking for a quadratic function, the definite integral of which is equal to \[2.170 t^2 - 17.61t - 58.725\]. Let’s start by forming the definite integral.

expr = sym.simplify((a*t**3 + b*t**2 + c*t + d) - (a*(t-12)**3 + b*(t-12)**2 + c*(t-12) + d)) print(sym.collect(expr,t))36*a*t**2 + 1728*a - 144*b + 12*c + t*(-432*a + 24*b)fitted_quadratic = t**2 * 2.17012649 + t*-17.61639881 -58.725Solving for the coefficients

Let’s now form a set of simultaneous equations and solve for each of the coefficients of \(t\).

equations = []

for i in [2,1,0]:

eq = sym.collect(expr,t).coeff(t, i)

coeff = sym.collect(fitted_quadratic,t).coeff(t, i)

equations.append(sym.Eq(eq,coeff))

result = sym.solve(equations,(a,b,c))

print(result){a: 0.0602812913888889, b: 0.351046627916667, c: -9.36169642500000}Finding the derivative

Now all that’s left to do is find the derivative of the indefinite integral.

expr = result[a] * t**3 + result[b]*t**2 + result[c]*t

print(sym.diff(expr, t))0.180843874166667*t**2 + 0.702093255833333*t - 9.361696425Voilà!